|

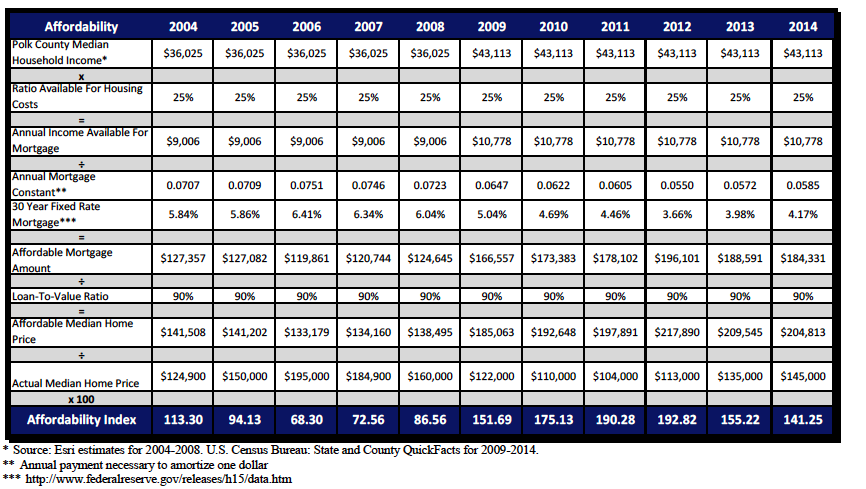

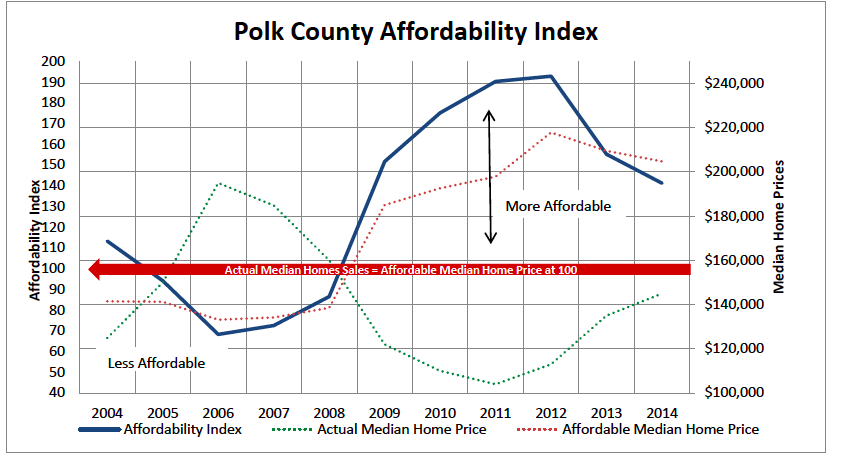

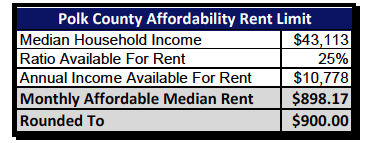

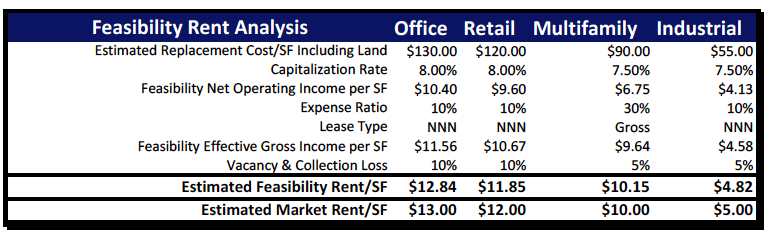

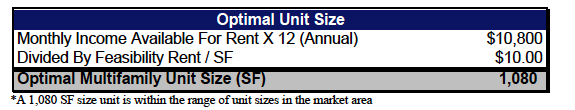

Polk County Real Estate Affordability and Feasibility by guest blogger Kyle Winningham, Winningham Appraisals, Inc. Polk County is building, just look around and new construction seems to be everywhere. One might ask… why? The following analysis explores a couple of aspects among the myriad of other variables influencing local single and multifamily development; the affordability of residential housing and the feasibility of new construction. Housing affordability is outlined in the grid below and constructs an index which compares the affordable median home price and the actual median home price. An affordability index of 100 indicates the affordable median price and actual median price are equal. More affordable housing is reflected by anything above 100 and less affordable housing is reflected by anything below 100. The calculations for determining the index is demonstrated within the following table. The index illustrates that single family homes are very affordable and there’s a disparity between how much the median household can afford to spend on housing and the actual median home price. New construction becomes feasible as the median home prices continue to trend upwards, closing the gap on economic obsolescence. Developers and builders recognize the income demographics’ ability to purchase above the median sale prices and aim to capitalize on the difference now that the market is nearing equilibrium. This, among many other factors, has contributed to new construction in the single family home segment. Affordable rental housing can also be calculated similarly as the affordable median home price. The only difference is that there’s no mortgage to consider making the affordable rent limit a much easier calculation. The optimum rent, based on the median household income is around $900. However, with regard to development, the question remains whether new construction is justified at the rent limit. The answer to this question lay in feasibility rent and the relation to achievable market rents. Feasibility rent is the rent necessary to justify new construction. When the market is at equilibrium, the rental rate for new, fully functional space is equal to feasibility rent. Feasibility rent for multifamily, as well other property types, is calculated in the table to follow. Other property types are included to provide insight on the Polk County real estate market overall. The estimated unit replacement costs are derived from data interpolated from the hundreds of appraisals I’ve completed as well as base cost information obtained from the Marshall Valuation Service Manual that is updated monthly. Office (not including medical office), retail, and multifamily property types within the analysis are average quality concrete improvements. Industrial property type is average quality metal over steel frame construction with minimal office finish. The estimated replacement costs do not take into consideration atypical land to building ratios. Land prices accounting for more than 30% of the replacement cost will significantly skew the results. Impact fees are considered and can vary significantly between county and other cities. There is an inherent margin of error for the replacement cost estimates and individual development projects will vary within that range. The market for property types within the confines of the parameters set forth in the analysis appear to have reached a point to justify new construction in areas that are achieving rental rates near the high end of the range of values. Multifamily property type is a unique point of interest and the information contained herein can quantify the optimal unit size, consequently maximizing returns. That important piece of information can drive development strategies and be adjusted to optimize target income demographics. For the $900/month price point at $10/SF feasibility rent, the optimal unit size is as follows. The commencement of new construction and developments in the area is partly attributed to markets participants’ willingness and ability (affordability) to purchase new homes at prices that justify construction. Additionally, the market of other property types can support rental rates commensurate with feasibility rates deeming new construction viable where demand warrants. Simply put, buyers, users, and developers are willing and able to meet their respective objectives while still satisfying the others’ financial goals. Thus, an incentive exists for new development and Polk County is building.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Upcoming Events |

|