|

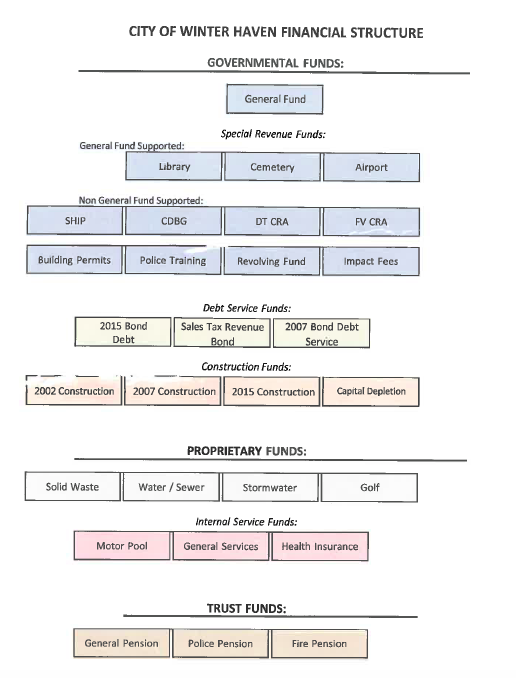

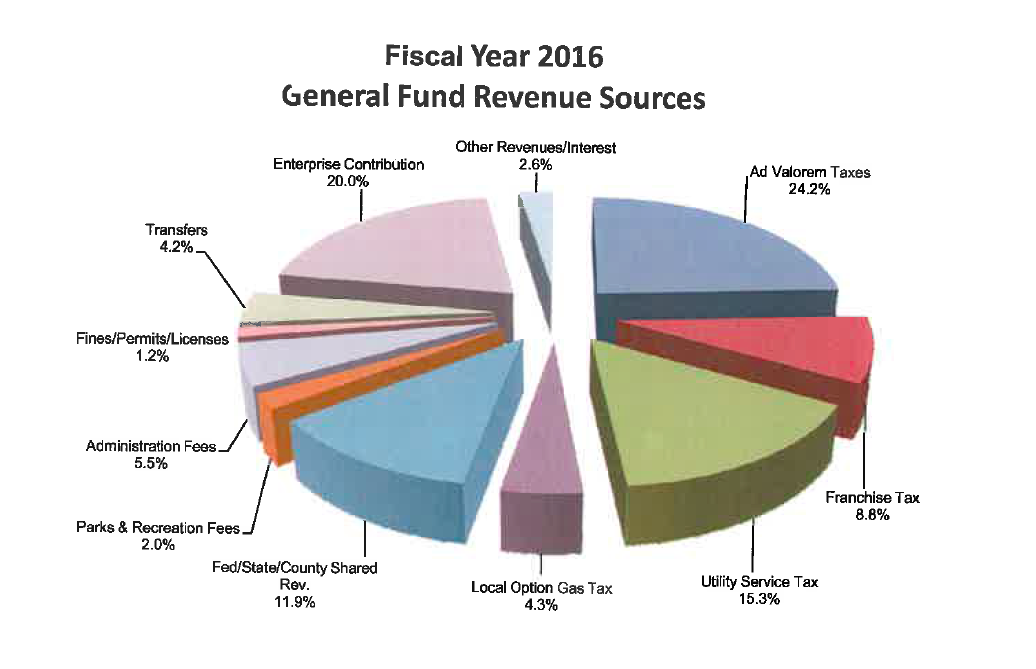

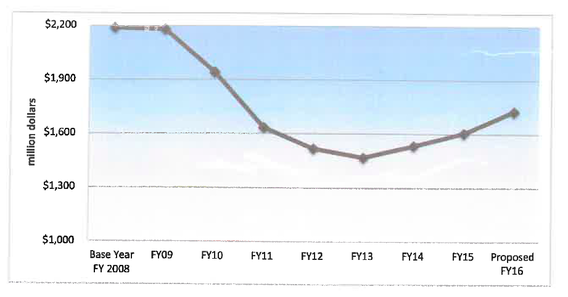

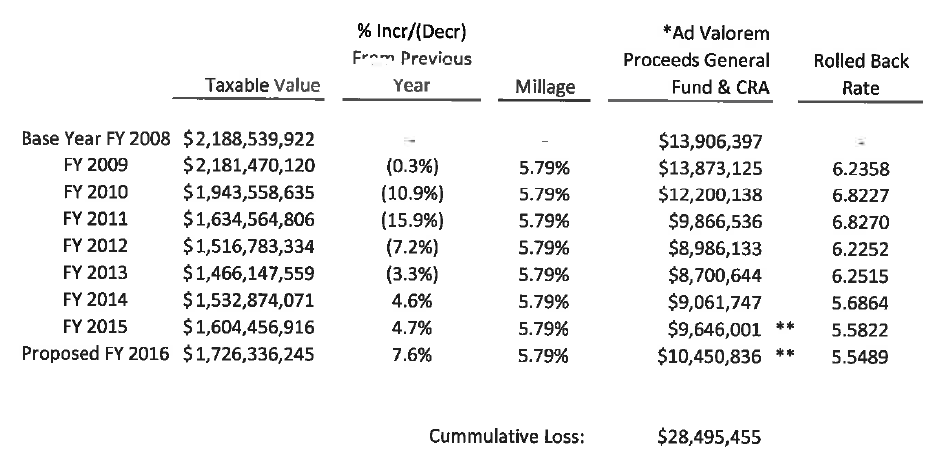

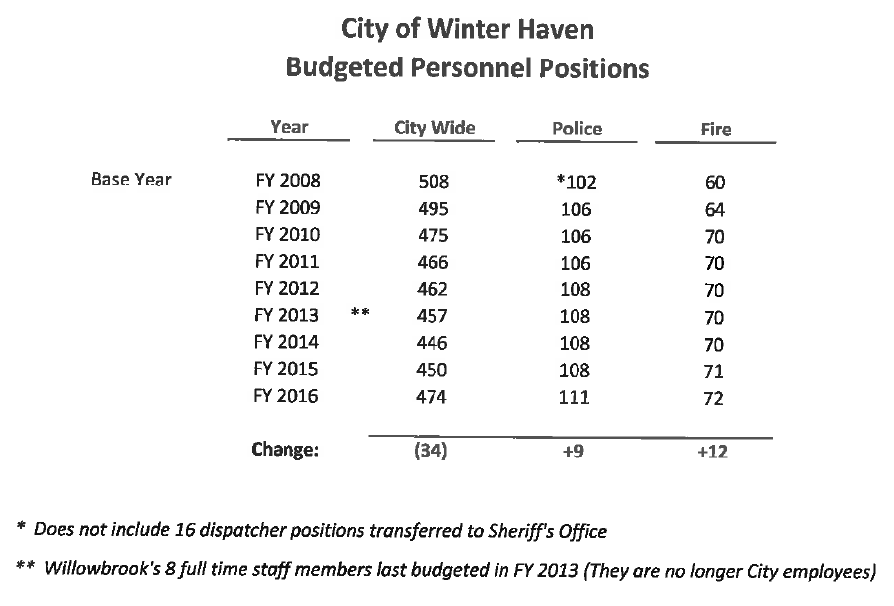

On Wednesday the Chamber's Government and Legislative Affairs committee and many other Chamber member businesses gathered for a presentation about the City of Winter Haven budget process and the plans for the 2015-2016 Fiscal Year. Cal Bowen, Financial Services Director, presented a very open and informative discussion. Below is a recap of the information shared as I understood it. Also included are explanations of the key issues and frequently misunderstood or asked questions. What is the Budget Process?The requirements for the City of Winter Haven budget (and all municipalities) is directed by state statute. All municipalities must: - Have a fiscal year that runs October 1 through September 30. - Adopt a balanced budget by October 1 - Make the tentative budget available on the city's website 2 days before the budget hearing (you can view it here) and post the final budget within 30 days of adoption. - The Florida Statute 166.241 goes on to explain how a budget can be amended. The budgeting process is about a 9 month process, beginning in January and ending when the budget is effective on October 1. (view the full budget calendar here). Pivotal points include when, on June 1, the property appraiser for the county provides the taxable value for the City and on July 1 when that tax roll is certified by the property appraiser. By August 4 (for this year anyway), the commission/city staff had to inform the property appraiser's office of the proposed millage rate (property tax rate). Public hearings on the budget will be held on September 15 (note Tuesday instead of Monday) and September 28 during the regularly scheduled commission meetings. How is the Budget Structured?The City budget is structured into three funds each with their own financials, think subsidiary companies, that make up the whole city budget – governmental funds, proprietary funds and trust funds. Starting from the bottom, trust funds are what you are probably familiar with - funds in which you are the stewards of other people's money. Next comes proprietary funds. Proprietary funds are broken down into two areas: Enterprise funds and Internal Service funds. Enterprise funds are used for services provided to the public on a user charge basis, similar to the operation of a commercial enterprise. They can be revenue generators for the city and profits can be reinvested into the city. Internal Service funds are used for operations serving other funds or departments within a government on a cost-reimbursement basis. The third is governmental funds. This includes the general fund, the special revenue funds (required to account for the use of revenue earmarked by law for a particular purpose), debt service funds and construction funds. The total proposed 2015-2016 City of Winter Haven budget is $107.7 million. Fact Check: I have seen it misquoted on social media that the City of Winter Haven 's budget is more than the City of Lakeland's budget. That is false. The City of Lakeland's general fund is roughly $102 million compared to Winter Haven's $38 million. Lakeland's entire budget is approximately $753 million compared to Winter Haven's $107 million. The General FundThe general fund is probably the fund that gets talked about the most as the services citizens identify most commonly with the city such as police, fire and recreation fall under the general fund. The City of Winter Haven's proposed revenues through the general fund for FY 2015-2016 total $38,036,581. People most closely associate the general fund with being tied to the ad valorem (or property tax rate), and that does account for 24.2% of the total general fund, but there are also other revenue sources. See the chart below. Enterprise contribution is the amount that is transferred from the proprietary enterprise funds to help cover the cost of city services that are not covered by the ad valorem and other revenue sources, including police and fire which make up over 50% of the general fund expenditures. You may hear some look at transferring funds as negative. Cal stated that the goal for any municipality would be to reduce the amount you need to transfer, but that the commissioners and staff supported the need to do it over the last several years. To understand it you have to look at the historic data of the general fund, property values and ad valorem collection. This chart illustrates how the total taxable value of City of Winter Haven property has changed since 2008. To give it to you in numbers in 2008 the total taxable value of property within the City of Winter Haven limits was $2,188,539,922. By 2013, the taxable value had dropped to $1,466,147,559. That is a 49.2% decrease. That means less money that can go into the general fund to for police, fire, parks and recreation, overhead expenses and the other items paid for by the general fund. During that same time period, the City Commission voted to keep the ad valorem millage rate at the same level (as it will remain the same in fiscal year 2015-2016) at 5.79%. In other words, they didn't want to increase the property taxes during the recession and still haven't. Roll back rates would have kept the city at the same level in revenue collection from the year before, adjusting for the loss in property value. Using those rates would have raised $28 million in additional revenue for the city. But they didn't do that. The commission voted to transfer monies from the enterprise proprietary funds to cover the difference. During this same time period, the City tightened it's belt to the greatest extent it believed it could without reducing the services it offered to the citizenry. Their staffing levels decreased from 508 in 2008 to 446 in 2014 through attrition (not replacing individuals that had retired or left). During this time period the only new positions added were firefighters and police officers. Fire AssessmentThe City of Winter Haven is currently considering a fire assessment fee that would provide a dedicated funding source to the fire department. In 2013- 2014, the City of Winter Haven's citizen efficiency review committee (a 12-person volunteer committee that spent a year looking at areas the city could become more efficient) discovered through their review that the highest users of fire services actually contribute little if anything to the city in taxes or fees due to their non-profit or exempt status. The committee recommended that the City look into this issue further. The City of Winter Haven proposed fire assessment program would be a 27% dedicated revenue source, not tied to property values. In other words, if property values dip and fluctuate again as they did over the last 7+ years, the fire departments funding through this program would remain. A fire assessment also broadens the base of payers versus only impacting those that pay property taxes through a millage rate increase. Cal explained that with the funds raised there could be the opportunity to decrease property taxes. By creating a dedicated funding source for the fire department, $1.6 million that is currently coming out of the general fund to supplement the department could be returned to the general fund to go towards other projects and priorities. To read the full white paper on the fire assessment as of July 2015 click here. Letters should begin to arrive in residents and businesses mailboxes on August 20th notifying of how the fee would affect them. This will be followed by a public hearing on September 8th. Fact check: Some of you may have been following the newspaper articles on the Lakeland proposed fire assessment fee. It is important to note some very basic differences. Initially the Lakeland Commission was considering funding a fire assessment at 100% to help to a budget variance of roughly $7+/- million. The City of Winter Haven's assessment is proposed at 27% and does not affect their ability to pass a balanced budget. The 2015 Construction FundThe new revenue source created through the fire assessment fee frees up roughly $1.6 million to go back into the general fund. With those additional monies, the City would like to address a growing project list requested by the residents. This list has been building for over 10 years and was developed through the original visioning plan of 2000, the Aspire Winter Haven visioning refresh of 2013, comments and suggestions at city commission meetings from residents and feedback from other public forums. The current proposed list of projects totals $18,255,000 and breaks down as follows: MLK Park - $2,500,000 Skate Park - $1,000,000 Lake Maude Complex- $3,000,000 Sertoma Park - $2,700,000 South Park - $3,500,000 Splash Pad - $400,000 Tennis Courts - $2,000,000 Roofs - $1,000,000 Seventh Street - $1,500,000 Contingency - $655,000 Funding for the projects is anticipated to come from the transfer of $1,215,000 from the 2007 Construction Fund and $17,240,000 from a bond issue. The projected bond issue is anticipated to be about $17.7 million when issue costs are included. Fact Check: A question could be asked as to whether monies should be spent on this versus other infrastructure improvements. It is important to note that other capital projects paid by other funds will be happening at the same time, just not addressed through this bond issuance. For example, Water & Sewer has $12 million in capital projects under their 2015-2016 budget. Research on several future transportation projects is also underway for future budget years. Pension PlanWhile the City's Pension plan was not discussed in depth at this meeting, an attendee did pose the question on the status of the discussion. Cal noted that the City has formed an independent citizen Blue Ribbon Committee made up of people that are familiar with pension funds. These individuals will review two actuarial reports/studies given to the city that basically told the city two different things. To really summarize it down, one reported stated that they City could do nothing and by 2021 the issue would begin to correct itself. The other report said the City has to make changes or will be stuck at the amount they are at now. The City Commission asked for the staff to continue to work on this through the Blue Ribbon Committee who will provide their opinions.

And if you have taken the time to read through this entire recap. Thank you. You are now better informed. Winter Haven is at a critical time where we have to be planning for our future.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Upcoming Events |

|